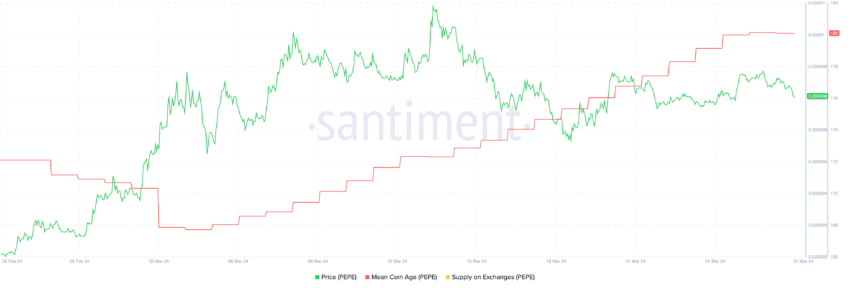

PEPE supply on exchanges saw a significant drop in just one day, signaling that holders anticipate a rise in value, as an increasing Mean Coin Age suggests a lack of selling pressure and a phase of accumulation.

Though EMA lines don’t show a strong bullish trend, they indicate potential consolidation, setting the stage for a possible price surge. Despite a 442.77% increase this year, PEPE price struggles to surpass and maintain above the $0.0000080 threshold.

PEPE Supply On Exchanges Triggered An Important Signal

Between March 25 and March 26, the PEPE supply on exchanges experienced a significant reduction, dropping from 180.7 trillion to 178.7 trillion.

Such a sizable decrease in supply available for trading can have a substantial impact on PEPE’s price, primarily due to the principles of supply and demand. When the supply of PEPE on exchanges diminishes, but demand remains constant or increases, it naturally leads to upward pressure on the price.

Historically, a precedent for this scenario occurred when a similar reduction in supply was promptly followed by a notable price surge—from $0.000008 to $0.0000106 in just one day.

This pattern suggests that the recent drop in exchange supply could be a precursor to another significant price increase for PEPE, as reduced availability on trading platforms may prompt a spike in buying interest and price.

PEPE Mean Coin Age Suggests Accumulation

Since the beginning of March, the Mean Coin Age for PEPE has been on a consistent upward trajectory. Mean Coin Age measures the average age of all coins in a network, calculated from the time they were last moved.

This metric serves as an indicator of investor behavior. A growing Mean Coin Age suggests that holders are increasingly opting to hold onto their coins rather than sell them, indicating a period of accumulation. This trend is generally seen as a bullish signal for the cryptocurrency, as it implies a strong holding sentiment among investors and a potential decrease in selling pressure, which can lead to price increases.

The Mean Coin Age has shown stability in the last three days, hinting that PEPE may be entering a consolidation phase. Consolidation periods often precede significant market movements as they reflect a balance between supply and demand before a new trend emerges.

This stabilization of Mean Coin Age, therefore, could be an early indicator that PEPE is gearing up for the next phase of price surges, as the market consolidates and prepares for future volatility.

PEPE Price Prediction: Can It Surpass Beyond $0.000011?

On March 14, PEPE reached its all-time peak, hitting a remarkable price of $0.0000106. Since reaching this pinnacle, it has encountered challenges in maintaining its value above the $0.0000080 mark, showing signs of struggle in the market.

Currently, three out of the four Exponential Moving Average (EMA) lines for PEPE are converging, aligning closely with the current price trajectory. This convergence, especially with short-term EMA lines positioned above the longer-term counterparts, sends a bullish signal to investors. This alignment suggests that the PEPE price might be stabilizing, potentially entering a phase of consolidation as market participants gauge their next moves.

Exponential Moving Averages (EMA) focus more on recent data, making them quicker to react than Simple Moving Averages (SMA). They give more weight to the latest prices, decreasing this weight for older data.

Read More: Pepe (PEPE) Price Prediction 2024/2025/2030

Rising supply on exchanges and Mean Coin Age for PEPE show holders want to keep their assets. They expect gains, setting PEPE up for potential price increases. If PEPE breaks the $0.0000085 level, it may reach $0.000011 for the first time. However, if it falls below $0.0000070 support, the price could dip to $0.0000049.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin  Ethereum

Ethereum  Solana

Solana  XRP

XRP  Cardano

Cardano  Shiba Inu

Shiba Inu  Polkadot

Polkadot